题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The Sales Contract provided that the sellers ()ship the goods before July 15.A、mustB、

The Sales Contract provided that the sellers ()ship the goods before July 15.

A、must

B、can

C、will

D、should

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The Sales Contract provided that the sellers ()ship the goods before July 15.

A、must

B、can

C、will

D、should

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“The Sales Contract provided th…”相关的问题

更多“The Sales Contract provided th…”相关的问题

Telephone Message

From: 1.()

To: David

Date: May 3rd, 2016

Time: 9:00 a.m.

Message: Jane called to say she would come to 2.()to discuss 3. ()next Monday. If convenient, you are 4.()to call her back. Her 5.()is 62634568.

Signed: Frank

11. Personal property is classified as either () or intangible.

12. A sales agreement is a () by which ownership is transferred from a seller to a buyer.

13. () laws are designed to protect both a person or firm that cannot pay its debts and the creditors involved.

14. The Chinese government () peace and cooperation, openness and inclusiveness, mutual learning and mutual benefit.

15. If you want to get securities services, you have to pay a ().

16. A firm that does not introduce new products to () declining products will eventually fail.

17. Prices may be () based on costs, demands, the competition's prices, or some combination of these.

18. Understanding buying behavior. helps marketers to () how buyers will respond to marketing strategies.

19. Compensation programs include wages and salaries, incentives and () for workers.

20. An institution's purpose, mission, and strategy affect its ().

replace established structure advocates

benefits commission predict

contract bankruptcy tangible

根据下列合同条款及审核要求审核英国伦敦米兰银行来证。

SALES CONTRACT

Contract No.: 055756

Date: 21st July,2011

Seller: Shanghai Cereals and Oil Imp. & Exp. Corporation

Buyer: ABC Company Limited 36-36 Kannon Street London U.K.

Commodities and Specification: Chinese White Rice Long-shaped

Broken Grains (Max): 5%

Admixture (Max): 0.25%

Moisture (Max): 15%

Quantity: 30 000 metric tons with 10% more or less at the seller's option

Packing: Packed in gunny bags of 50kg each

Unit Price: USD400 per M/T FOB stowed Shanghai gross for net

Amount: USD12000000 (SAY TWELVE MILLION ONLY)

Shipment: during OCt./NOv. 2011 from Shanghai to London with partial shipments and

transshipment is allowed

Insurance: To be covered by the buyer

Payment: By Irrevocable L/C payable at sight for negotiation in China within 15 days after

the shipment

Midland Bank Ltd., London

AUG. 18th,2011

Advising Bank: Applicant: ABC Company Ltd.

Bank of China Shanghai Branch

Beneficiary: Amount: Not exceeding USD12000000

Shanghai cereals and oil

Imp. & Exp. Corp.

Shanghai China

Dear Sirs,

At the request of ABC Co., Ltd., London, we hereby issue in your favour this revocabledocumentary credit No. 219307 which is available by negotiation of your draft at 30 days after sight forfull invoice value drawn on us bearing the clause: “Drawn under documentary credit No. 219307 ofMidland Bank Ltd.,”accompanied by the following documents:

1. Signed commercial invoice in 3 copies.

2. Full set of 2/3 clean on board bills of lading made out to order and bank endorsed marked“Freight Prepaid” and notify applicant.

3. Certificate of origin issued by AQSIQ.

4. Insurance policy for full invoice value plus 10% covering all risks and war risks as per ICCdated JAN. 1st, 2009.

5. Inspection certificate issued by applicant.

6. Beneficiary's certificate fax to applicant within 24 hours after shipment stating contract number,credit number, vessel name and shipping date.

Covering 30 000 metric tons Chinese White Rice Long-shaped

Broken Grains: 5%

Admixture: 0.25%

Moisture: 15%

At USD400.00 per M/T FOB Shanghai, packed in plastic bags.

Shipment from Chinese port to London during OCt./NOv. 2011.

Transshipment is prohibited, partial shipment prohibited.

This credit is valid for negotiation before DEC. 15th,2011 in London.

Special Conditions: Documents must be presented for negotiation within 5 days after the date ofissuance of the bills of lading, but in any event within this credit validity.

We hereby undertake to honour all drafts drawn in accordance with the terms of this credit. Theadvising bank is kindly requested to notify the beneficiary without adding their confirmation forMidland Bank Ltd., London.

It is subject to the Uniform Customs and Practice for Documentary Credit (2007 Revision),International Chamber of Commerce Publication NO. 600.

SIGNATURES

A.如果广告投入增长一倍,预测销售量的增长

B.如果商品价格涨价一倍,预测销售量P′(sales)的变化

C.如果放弃吸烟,预测癌症P′(cancer)的概率

D.购买了A商品的顾客是否会购买B商品

Section A – This ONE question is compulsory and MUST be attempted

Cocoa-Mocha-Chai (CMC) Co is a large listed company based in Switzerland and uses Swiss Francs as its currency. It imports tea, coffee and cocoa from countries around the world, and sells its blended products to supermarkets and large retailers worldwide. The company has production facilities located in two European ports where raw materials are brought for processing, and from where finished products are shipped out. All raw material purchases are paid for in US dollars (US$), while all sales are invoiced in Swiss Francs (CHF).

Until recently CMC Co had no intention of hedging its foreign currency exposures, interest rate exposures or commodity price fluctuations, and stated this intent in its annual report. However, after consultations with senior and middle managers, the company’s new Board of Directors (BoD) has been reviewing its risk management and operations strategies.

The following two proposals have been put forward by the BoD for further consideration:

Proposal one

Setting up a treasury function to manage the foreign currency and interest rate exposures (but not commodity price fluctuations) using derivative products. The treasury function would be headed by the finance director. The purchasing director, who initiated the idea of having a treasury function, was of the opinion that this would enable her management team to make better decisions. The finance director also supported the idea as he felt this would increase his influence on the BoD and strengthen his case for an increase in his remuneration.

In order to assist in the further consideration of this proposal, the BoD wants you to use the following upcoming foreign currency and interest rate exposures to demonstrate how they would be managed by the treasury function:

(i) a payment of US$5,060,000 which is due in four months’ time; and

(ii) a four-year CHF60,000,000 loan taken out to part-fund the setting up of four branches (see proposal two below). Interest will be payable on the loan at a fixed annual rate of 2·2% or a floating annual rate based on the yield curve rate plus 0·40%. The loan’s principal amount will be repayable in full at the end of the fourth year.

Proposal two

This proposal suggested setting up four new branches in four different countries. Each branch would have its own production facilities and sales teams. As a consequence of this, one of the two European-based production facilities will be closed. Initial cost-benefit analysis indicated that this would reduce costs related to production, distribution and logistics, as these branches would be closer to the sources of raw materials and also to the customers. The operations and sales directors supported the proposal, as in addition to above, this would enable sales and marketing teams in the branches to respond to any changes in nearby markets more quickly. The branches would be controlled and staffed by the local population in those countries. However, some members of the BoD expressed concern that such a move would create agency issues between CMC Co’s central management and the management controlling the branches. They suggested mitigation strategies would need to be established to minimise these issues.

Response from the non-executive directors

When the proposals were put to the non-executive directors, they indicated that they were broadly supportive of the second proposal if the financial benefits outweigh the costs of setting up and running the four branches. However, they felt that they could not support the first proposal, as this would reduce shareholder value because the costs related to undertaking the proposal are likely to outweigh the benefits.

Additional information relating to proposal one

The current spot rate is US$1·0635 per CHF1. The current annual inflation rate in the USA is three times higher than Switzerland.

The following derivative products are available to CMC Co to manage the exposures of the US$ payment and the interest on the loan:

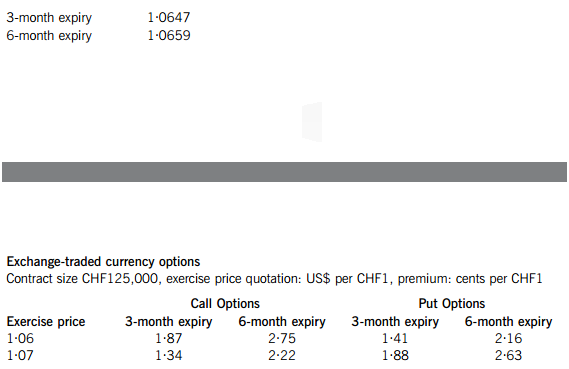

Exchange-traded currency futures

Contract size CHF125,000 price quotation: US$ per CHF1

It can be assumed that futures and option contracts expire at the end of the month and transaction costs related to these can be ignored.

Over-the-counter products

In addition to the exchange-traded products, Pecunia Bank is willing to offer the following over-the-counter derivative products to CMC Co:

(i) A forward rate between the US$ and the CHF of US$ 1·0677 per CHF1.

(ii) An interest rate swap contract with a counterparty, where the counterparty can borrow at an annual floating rate based on the yield curve rate plus 0·8% or an annual fixed rate of 3·8%. Pecunia Bank would charge a fee of 20 basis points each to act as the intermediary of the swap. Both parties will benefit equally from the swap contract.

Required:

(a) Advise CMC Co on an appropriate hedging strategy to manage the foreign exchange exposure of the US$ payment in four months’ time. Show all relevant calculations, including the number of contracts bought or sold in the exchange-traded derivative markets. (15 marks)

(b) Demonstrate how CMC Co could benefit from the swap offered by Pecunia Bank. (6 marks)

(c) As an alternative to paying the principal on the loan as one lump sum at the end of the fourth year, CMC Co could pay off the loan in equal annual amounts over the four years similar to an annuity. In this case, an annual interest rate of 2% would be payable, which is the same as the loan’s gross redemption yield (yield to maturity).

Required: Calculate the modified duration of the loan if it is repaid in equal amounts and explain how duration can be used to measure the sensitivity of the loan to changes in interest rates. (7 marks)

(d) Prepare a memorandum for the Board of Directors (BoD) of CMC Co which:

(i) Discusses proposal one in light of the concerns raised by the non-executive directors; and (9 marks)

(ii) Discusses the agency issues related to proposal two and how these can be mitigated. (9 marks)

Professional marks will be awarded in part (d) for the presentation, structure, logical flow and clarity of the memorandum. (4 marks)

Introduction

The following is an interview with Mick Kazinski, a senior marketing executive with Bridge Co, a Deeland-based construction company. It concerns their purchase of Custcare, a Customer Relationship Management (CRM) software package written by the Custcare Corporation, a software company based in Solland, a country some 4,000 km away from Deeland. The interview was originally published in the Management Experiences magazine.

Interviewer: Thanks for talking to us today Mick. Can you tell us how Bridge Co came to choose the Custcare software package?

Mick: Well, we didn’t choose it really. Teri Porter had just joined the company as sales and marketing director. She had recently implemented the Custcare package at her previous company and she was very enthusiastic about it. When she found out that we did not have a CRM package at Bridge Co, she suggested that we should also buy the Custcare package as she felt that our requirements were very similar to those of her previous company. We told her that any purchase would have to go through our capex (capital expenditure) system as the package cost over $20,000. Here at Bridge Co, all capex applications have to be accompanied by a formal business case and an Invitation to Tender (ITT) has to be sent out to at least three potential suppliers. However, Teri is a very clever lady. She managed to do a deal with Custcare and they agreed to supply the package at a cost of $19,995, just under the capex threshold. Teri had to cut a few things out. For example, we declined the training courses (Teri said the package was an easy one to use and she would show us how to use it) and also we opted for the lowest level of support, something we later came to regret. Overall, we were happy. We knew that Custcare was a popular and successful CRM package.

Interviewer: So, did you have a demonstration of the software before you bought it?

Mick: Oh yes, and everyone was very impressed. It seemed to do all the things we would ever want it to do and, in fact, it gave us some ideas about possibilities that we would never have thought of. Also, by then, it was clear that our internal IT department could not provide us with a bespoke solution. Teri had spoken to them informally and she was told that they could not even look at our requirements for 18 months. In contrast, we could be up and running with the Custcare package within three months. Also, IT quoted an internal transfer cost of $18,000 for just defining our requirements. This was almost as much as we were paying for the whole software solution!

Interviewer: When did things begin to go wrong?

Mick: Well, the implementation was not straightforward. We needed to migrate some data from our current established systems and we had no-one who could do it. We tried to recruit some local technical experts, but Custcare pointed out that we had signed their standard contract which only permitted Custcare consultants to work on such tasks. We had not realised this, as nobody had read the contract carefully. In the end, we had to give in and it cost us $10,000 in fees to migrate the data from some of our internal systems to the new package. Teri managed to get the money out of the operational budget, but we weren’t happy.

We then tried to share data between the Custcare software and our existing order processing system. We thought this would be easy, but apparently the file formats are incompatible. Thus we have to enter customer information into two systems and we are unable to exploit the customer order analysis facility of the Custcare CRM.

Finally, although we were happy with the functionality and reliability of the Custcare software, it works very slowly. This is really very disappointing. Some reports and queries have to be aborted because the software appears to have hung. The software worked very quickly in the demonstration, but it is painfully slow now that it is installed on our IT platform.

Interviewer: What is the current situation?

Mick: Well, we are all a bit deflated and disappointed in the package. The software seems reasonable enough, but its poor performance and our inability to interface it to the order processing system have reduced users’ confidence in the system. Because users have not been adequately trained, we have had to phone Custcare’s support desk more than we should. However, as I said before, we took the cheapest option. This is for a help line to be available from 8.00 hrs to 17.00 hrs Solland time. As you know, Solland is in a completely different time zone and so we have had to stay behind at work and contact them in the late evening. Again, nobody had closely read the terms of the contract. We have taken legal advice, but we have also found that, for dispute resolution, the contract uses the commercial contract laws of Solland. Nobody in Bridge Co knows what these are! Our solicitor said that we should have asked for this specification to be changed when the contract was drawn up. I just wish we had chosen a product produced by a company here in Deeland. It would have made it much easier to resolve issues and disputes.

Interviewer: What does Teri think?

Mick: Not a lot! She has left us to rejoin her old company in a more senior position. The board did ask her to justify her purchase of the Custcare CRM package, but I don’t think she ever did. I am not sure that she could!

Required:

(a) Suggest a process for evaluating, selecting and implementing a software package solution and explain how this process would have prevented the problems experienced at Bridge Co in the Custcare CRM application. (15 marks)

(b) The CEO of Bridge Co now questions whether buying a software package was the wrong approach to meeting the CRM requirements at Bridge Co. He wonders whether they should have commissioned a bespoke software system instead.

Explain, with reference to the CRM project at Bridge Co, the advantages of adopting a software package approach to fulfilling business system requirements compared with a bespoke software solution. (10 marks)

A.usiness;invoiCe;ContraCt

B.oreign;trade ContraCt;invoiCe

C.usiness;LC;ContraCt

D.oreign trade;invoiCe;ContraCt