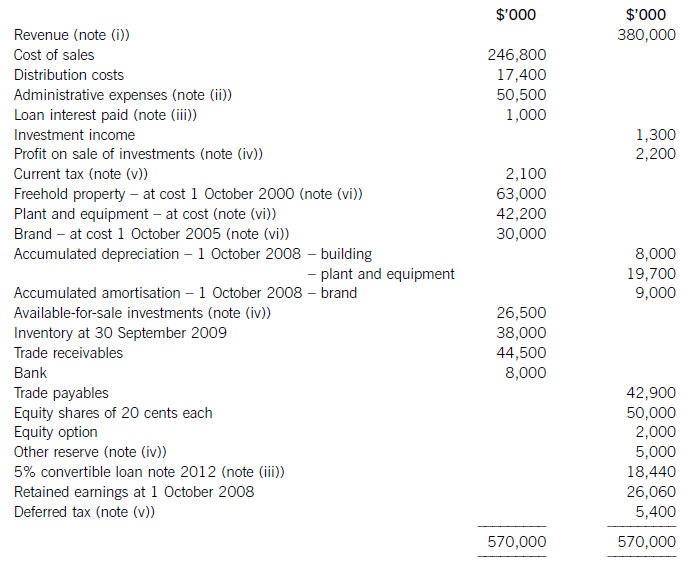

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

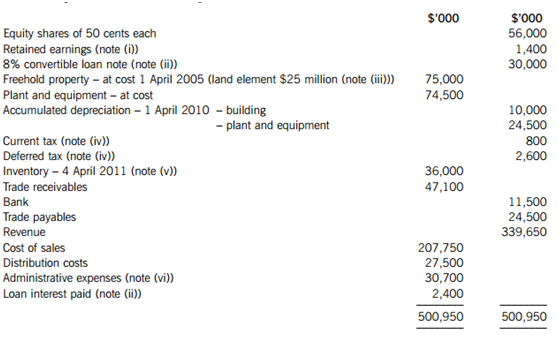

The following trial balance relates to Highwood at 31 March 2011:The following notes are r

The following trial balance relates to Highwood at 31 March 2011:

The following notes are relevant:

(i) An equity dividend of 5 cents per share was paid in November 2010 and charged to retained earnings.

(ii) The 8% $30 million convertible loan note was issued on 1 April 2010 at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par on 31 March 2013 or convertible into equity shares at the option of the loan note holders on the basis of 30 equity shares for each $100 of loan note. Highwood’s finance director has calculated that to issue an equivalent loan note without the conversion rights it would have to pay an interest rate of 10% per annum to attract investors.

The present value of $1 receivable at the end of each year, based on discount rates of 8% and 10% are:

(iii) Non-current assets:

On 1 April 2010 Highwood decided for the first time to value its freehold property at its current value. A qualified property valuer reported that the market value of the freehold property on this date was $80 million, of which $30 million related to the land. At this date the remaining estimated life of the property was 20 years. Highwood does not make a transfer to retained earnings in respect of excess depreciation on the revaluation of its assets.

Plant is depreciated at 20% per annum on the reducing balance method.

All depreciation of non-current assets is charged to cost of sales.

(iv) The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2010. The required provision for income tax for the year ended 31 March 2011 is $19·4 million. The difference between the carrying amounts of the net assets of Highwood (including the revaluation of the property in note (iii) above) and their (lower) tax base at 31 March 2011 is $27 million. Highwood’s rate of income tax is 25%.

(v) The inventory of Highwood was not counted until 4 April 2011 due to operational reasons. At this date its value at cost was $36 million and this figure has been used in the cost of sales calculation above. Between the year end of 31 March 2011 and 4 April 2011, Highwood received a delivery of goods at a cost of $2·7 million and made sales of $7·8 million at a mark-up on cost of 30%. Neither the goods delivered nor the sales made in this period were included in Highwood’s purchases (as part of cost of sales) or revenue in the above trial balance.

(vi) On 31 March 2011 Highwood factored (sold) trade receivables with a book value of $10 million to Easyfinance. Highwood received an immediate payment of $8·7 million and will pay Easyfinance 2% per month on any uncollected balances. Any of the factored receivables outstanding after six months will be refunded to Easyfinance. Highwood has derecognised the receivables and charged $1·3 million to administrative expenses. If Highwood had not factored these receivables it would have made an allowance of $600,000 against them.

Required:

(i) Prepare the statement of comprehensive income for Highwood for the year ended 31 March 2011;

(ii) Prepare the statement of changes in equity for Highwood for the year ended 31 March 2011;

(iii) Prepare the statement of financial position of Highwood as at 31 March 2011.

Note: your answers and workings should be presented to the nearest $1,000; notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(i) 11 marks

(ii) 4 marks

(iii) 10 marks

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“The following trial balance re…”相关的问题

更多“The following trial balance re…”相关的问题