题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

All the directors agreed to hold a press ()for the company next month.

A.conference

B.party

C.team

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.conference

B.party

C.team

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“All the directors agreed to ho…”相关的问题

更多“All the directors agreed to ho…”相关的问题

A.They are appointed by all the promoters of the company

B.They are appointed by the general meeting of the shareholders

C.They are appointed by the board of directors and approved by the general meeting of the shareholders

D.They are appointed by the board of directors

The main idea of the passage is given in the sentence beginning with "______"

A.Not long ago a California policeman stopped…

B.Thousands of babies are given strange names…

C.There's a Katz Neow in Washington D.C.…

D.But perhaps the strangest name of all is…

•Read the article below about the importance of communication in business.

•Choose the best word to fill each gap from A, B, C or D on the opposite page.

•For each question 21-30, mark one letter (A, B, C or D) on your Answer Sheet.

Business communication

One of the most important features in any business is communication. Good communications are required at all stages of the business process. Businesses employ, and are owned and run by, various groups of people. Workers, directors and shareholders are three important groups closely (21) with a business. Other influential groups include customers, suppliers and the government.

Communication (22) between these groups and the individuals who make up the groups. Within (23) companies internal communications occur at, and between the various levels. Directors communicate with one another concerning the company's overall strategy. They (24) managers of their plans, and the managers then communicate with the other employees (25) are conducted concerning pay and working conditions. Managers communicate decisions and orders and try to (26) morale and motivation through good communication. Employees (27) communicate with each other, for example over production and wages.

External communication occurs when a company's directors or employees communicate with those individuals and groups who (28) with the company. Shareholders receive copies of the company's annual accounts, together with the (29) of the Chairman and Directors. Government departments require statistical and financial information from the company. An advertising agency is (30) about the company's advertising policies. Customers need to know if goods have not been despatched and suppliers contacted if their goods have not been delivered. Reliable and effective communication is one of the key elements which leads to efficient management of a company.

(21)

A.implicated

B.committed

C.involved

D.interested

Saxophone Enterprises Co (Saxophone) has been trading for 15 years selling insurance and has recently become a listed company. In accordance with corporate governance principles Saxophone maintains a small internal audit department. The directors feel that the team needs to increase in size and specialist skills are required, but they are unsure whether to recruit more internal auditors, or to outsource the whole function to their external auditors, Cello & Co.

Saxophone is required to comply with corporate governance principles in order to maintain its listed status; hence the finance director has undertaken a review of whether or not the company complies.

Bill Bassoon is the chairman of Saxophone, until last year he was the chief executive. Bill is unsure if Saxophone needs more non-executive directors as there are currently three non-executive directors out of the eight board members. He is considering appointing one of his close friends, who is a retired chief executive of a manufacturing company, as a non-executive director.

The finance director, Jessie Oboe, decides on the amount of remuneration each director is paid. Currently all remuneration is in the form. of an annual bonus based on profits. Jessie is considering setting up an audit committee, but has not undertaken this task yet as she is very busy. A new sales director was appointed nine months ago. He has yet to undertake his board training as this is normally provided by the chief executive and this role is currently vacant.

There are a large number of shareholders and therefore the directors believe that it is impractical and too costly to hold an annual general meeting of shareholders. Instead, the board has suggested sending out the financial statements and any voting resolutions by email; shareholders can then vote on the resolutions via email.

Required:

(a) Explain the advantages and disadvantages for each of Saxophone Enterprises Co AND Cello & Co of outsourcing the internal audit department.

Note: The total marks will be split as follows:

Saxophone Enterprises Co (8 marks)

Cello & Co (2 marks) (10 marks)

(b) In respect of the corporate governance of Saxophone Enterprises Co:

(i) Identify and explain FIVE corporate governance weaknesses; and

(ii) Provide a recommendation to address each weakness.

Note: The total marks will be split equally between each part. (10 marks)

Section A – This ONE question is compulsory and MUST be attempted

Cocoa-Mocha-Chai (CMC) Co is a large listed company based in Switzerland and uses Swiss Francs as its currency. It imports tea, coffee and cocoa from countries around the world, and sells its blended products to supermarkets and large retailers worldwide. The company has production facilities located in two European ports where raw materials are brought for processing, and from where finished products are shipped out. All raw material purchases are paid for in US dollars (US$), while all sales are invoiced in Swiss Francs (CHF).

Until recently CMC Co had no intention of hedging its foreign currency exposures, interest rate exposures or commodity price fluctuations, and stated this intent in its annual report. However, after consultations with senior and middle managers, the company’s new Board of Directors (BoD) has been reviewing its risk management and operations strategies.

The following two proposals have been put forward by the BoD for further consideration:

Proposal one

Setting up a treasury function to manage the foreign currency and interest rate exposures (but not commodity price fluctuations) using derivative products. The treasury function would be headed by the finance director. The purchasing director, who initiated the idea of having a treasury function, was of the opinion that this would enable her management team to make better decisions. The finance director also supported the idea as he felt this would increase his influence on the BoD and strengthen his case for an increase in his remuneration.

In order to assist in the further consideration of this proposal, the BoD wants you to use the following upcoming foreign currency and interest rate exposures to demonstrate how they would be managed by the treasury function:

(i) a payment of US$5,060,000 which is due in four months’ time; and

(ii) a four-year CHF60,000,000 loan taken out to part-fund the setting up of four branches (see proposal two below). Interest will be payable on the loan at a fixed annual rate of 2·2% or a floating annual rate based on the yield curve rate plus 0·40%. The loan’s principal amount will be repayable in full at the end of the fourth year.

Proposal two

This proposal suggested setting up four new branches in four different countries. Each branch would have its own production facilities and sales teams. As a consequence of this, one of the two European-based production facilities will be closed. Initial cost-benefit analysis indicated that this would reduce costs related to production, distribution and logistics, as these branches would be closer to the sources of raw materials and also to the customers. The operations and sales directors supported the proposal, as in addition to above, this would enable sales and marketing teams in the branches to respond to any changes in nearby markets more quickly. The branches would be controlled and staffed by the local population in those countries. However, some members of the BoD expressed concern that such a move would create agency issues between CMC Co’s central management and the management controlling the branches. They suggested mitigation strategies would need to be established to minimise these issues.

Response from the non-executive directors

When the proposals were put to the non-executive directors, they indicated that they were broadly supportive of the second proposal if the financial benefits outweigh the costs of setting up and running the four branches. However, they felt that they could not support the first proposal, as this would reduce shareholder value because the costs related to undertaking the proposal are likely to outweigh the benefits.

Additional information relating to proposal one

The current spot rate is US$1·0635 per CHF1. The current annual inflation rate in the USA is three times higher than Switzerland.

The following derivative products are available to CMC Co to manage the exposures of the US$ payment and the interest on the loan:

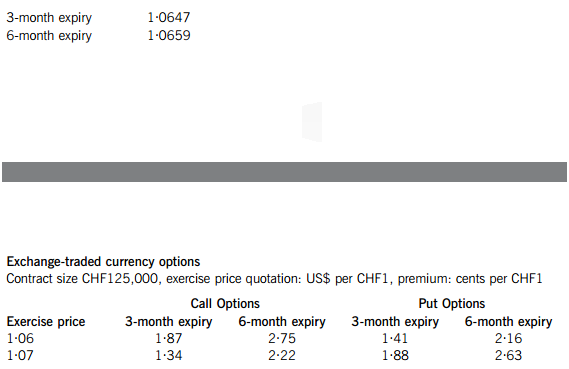

Exchange-traded currency futures

Contract size CHF125,000 price quotation: US$ per CHF1

It can be assumed that futures and option contracts expire at the end of the month and transaction costs related to these can be ignored.

Over-the-counter products

In addition to the exchange-traded products, Pecunia Bank is willing to offer the following over-the-counter derivative products to CMC Co:

(i) A forward rate between the US$ and the CHF of US$ 1·0677 per CHF1.

(ii) An interest rate swap contract with a counterparty, where the counterparty can borrow at an annual floating rate based on the yield curve rate plus 0·8% or an annual fixed rate of 3·8%. Pecunia Bank would charge a fee of 20 basis points each to act as the intermediary of the swap. Both parties will benefit equally from the swap contract.

Required:

(a) Advise CMC Co on an appropriate hedging strategy to manage the foreign exchange exposure of the US$ payment in four months’ time. Show all relevant calculations, including the number of contracts bought or sold in the exchange-traded derivative markets. (15 marks)

(b) Demonstrate how CMC Co could benefit from the swap offered by Pecunia Bank. (6 marks)

(c) As an alternative to paying the principal on the loan as one lump sum at the end of the fourth year, CMC Co could pay off the loan in equal annual amounts over the four years similar to an annuity. In this case, an annual interest rate of 2% would be payable, which is the same as the loan’s gross redemption yield (yield to maturity).

Required: Calculate the modified duration of the loan if it is repaid in equal amounts and explain how duration can be used to measure the sensitivity of the loan to changes in interest rates. (7 marks)

(d) Prepare a memorandum for the Board of Directors (BoD) of CMC Co which:

(i) Discusses proposal one in light of the concerns raised by the non-executive directors; and (9 marks)

(ii) Discusses the agency issues related to proposal two and how these can be mitigated. (9 marks)

Professional marks will be awarded in part (d) for the presentation, structure, logical flow and clarity of the memorandum. (4 marks)

Section B – TWO questions ONLY to be attempted

Louieed Co

Louieed Co, a listed company, is a major supplier of educational material, selling its products in many countries. It supplies schools and colleges and also produces learning material for business and professional exams. Louieed Co has exclusive contracts to produce material for some examining bodies. Louieed Co has a well-defined management structure with formal processes for making major decisions.

Although Louieed Co produces online learning material, most of its profits are still derived from sales of traditional textbooks. Louieed Co’s growth in profits over the last few years has been slow and its directors are currently reviewing its long-term strategy. One area in which they feel that Louieed Co must become much more involved is the production of online testing materials for exams and to validate course and textbook learning.

Bid for Tidded Co

Louieed Co has recently made a bid for Tidded Co, a smaller listed company. Tidded Co also supplies a range of educational material, but has been one of the leaders in the development of online testing and has shown strong profit growth over recent years. All of Tidded Co’s initial five founders remain on its board and still hold 45% of its issued share capital between them. From the start, Tidded Co’s directors have been used to making quick decisions in their areas of responsibility. Although listing has imposed some formalities, Tidded Co has remained focused on acting quickly to gain competitive advantage, with the five founders continuing to give strong leadership.

Louieed Co’s initial bid of five shares in Louieed Co for three shares in Tidded Co was rejected by Tidded Co’s board. There has been further discussion between the two boards since the initial offer was rejected and Louieed Co’s board is now considering a proposal to offer Tidded Co’s shareholders two shares in Louieed Co for one share in Tidded Co or a cash alternative of $22·75 per Tidded Co share. It is expected that Tidded Co&39;s shareholders will choose one of the following options:

(i) To accept the two-shares-for-one-share offer for all the Tidded Co shares; or,

(ii) To accept the cash offer for all the Tidded Co shares; or,

(iii) 60% of the shareholders will take up the two-shares-for-one-share offer and the remaining 40% will take the cash offer.

In case of the third option being accepted, it is thought that three of the company&39;s founders, holding 20% of the share capital in total, will take the cash offer and not join the combined company. The remaining two founders will probably continue to be involved in the business and be members of the combined company&39;s board.

Louieed Co’s finance director has estimated that the merger will produce annual post-tax synergies of $20 million. He expects Louieed Co’s current price-earnings (P/E) ratio to remain unchanged after the acquisition.

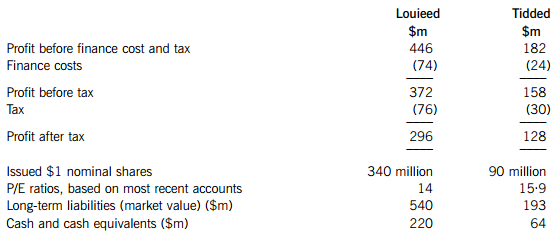

Extracts from the two companies’ most recent accounts are shown below:

The tax rate applicable to both companies is 20%.

Assume that Louieed Co can obtain further debt funding at a pre-tax cost of 7·5% and that the return on cash surpluses is 5% pre-tax.

Assume also that any debt funding needed to complete the acquisition will be reduced instantly by the balances of cash and cash equivalents held by Louieed Co and Tidded Co.

Required:

(a) Discuss the advantages and disadvantages of the acquisition of Tidded Co from the viewpoint of Louieed Co. (6 marks)

(b) Calculate the P/E ratios of Tidded Co implied by the terms of Louieed Co’s initial and proposed offers, for all three of the above options. (5 marks)

(c) Calculate, and comment on, the funding required for the acquisition of Tidded Co and the impact on Louieed Co’s earnings per share and gearing, for each of the three options given above.

Note: Up to 10 marks are available for the calculations. (14 marks)

E-mail or electronic mail, is considered as the modem communication in the new age. It iscarried out in computers all over the world by millions of users. In this invisible world as many people call it,the users can send and receive letters to and from every comer of the earth. They share thoughts with pen pals (笔友)in New Zealand,ask strangers in Bombay (孟买)questions,debate with businessman in Manhattan. All of these are just happening in computers as fast as the travelling of the light,no writing and speaking,no paper and stamps are necessary.

E-mail is a pipeline to thousands of experts on everything;it is a means of meeting people with similar interests or problems. But it is not a live talk—a real conversation like those in telephones.E-mailers compose letters at leisure on their computers, then send them by phone line to an on-line service,and then they go forward to the right place. A response can be back within hours,depending on how often the recipient(接受者)checks in.

A vast global networks of on-line services for E-mail has been built. A lot of people are regularly using this service in the USA. People believe that E-mail, the computerized exchange, would create friendship and business developments, and would change people’ s life in the world. Which of the following expression is not for E-mail?

A.Communication in new ag

B.Invisible world

C.A live talk

D.Computerized exchange

Which of the following does the writer think is a shortcoming of E-mail?A.Happening as fast as the travelling of light.

B.No writing and speaking

C.No paper and stamps.

D.Response depending on the recipient.

Which of the following is NOT true?A.E-mail is carried out in computers.

B.A response of an E-mail depends on how often the recipient checks in.

C.People don, t believe that E-mail will create friendship.

D.E-mail is not a real conversation.

The directors will meet tomorrow, ______the schedule is changed.

A. if

B. but

C. unless

D. or

Initial calculations suggest that the proposed investment in Naswa would have a negative net present value of $1·01 million. However, Furlion Co’s chief executive believes that there may be opportunities for greater cash flows in future if the Naswan government expands its land reclamation programme. The government at present is struggling to fund expansion of the programme out of its own resources and is looking for other funding. If the Naswan government obtains this funding, the chief executive has forecast that the increased demand for Furlion Co’s products would justify $15 million additional expenditure at the site of the factory in three years’ time. The expected net present value for this expansion is currently estimated to be $0.

It can be assumed that all costs and revenues include inflation. The relevant cost of capital is 12% and the risk free rate is 4%. The chief executive has estimated the likely volatility of cash flows at a standard deviation of 30%.

One of Furlion Co’s non-executive directors has read about possible changes in interest rates and wonders how these might affect the investment appraisal.

Required:

(a) Assess, showing all relevant calculations, whether Furlion Co should proceed with the significant opportunity. Discuss the assumptions made and other factors which will affect the decision of whether to establish a plant in Naswa. The Black Scholes pricing model may be used, where appropriate. (16 marks)

(b) Explain what is meant by an option’s rho and discuss the impact of changes in interest rates on the appraisal of the investment. (5 marks)

(c) Discuss the possibility of the Naswan government obtaining funding for further land reclamation from the World Bank, referring specifically to the International Development Association. (4 marks)

Read the article below about the central problem of Economics.

Choose the best word to fill each gap, from A, B, C or D.

For each question 19—33, mark one letter (A, B, C or D) on your Answer Sheet.

There is an example at the beginning.

The Central Problem of Economics

The central problem of economics is to satisfy the people's and nation's wants.

The problem we are faced with is that our resources, here identified as money, are limited. The only way we can resolve our problem is to make choices. After looking at our resources, we must examine our list of(19)…and identify the things we need immediately, those we can postpone, and(20)…we cannot afford. As individuals, we face the central problem involved in economics—deciding just how to allocate (分配)our limited resources to provide(21)…with the greatest satisfaction of our wants.

Nations face the same problem. As a country's population grows the need for more goods and services grows correspondingly. Resources necessary to production may increase, but there(22)…are enough resources to satisfy the total desires of a nation. Whether the budget meeting is taking place in the family(23) …room, in the conference room of the corporation (24)…of directors, or in the chamber of the House of Representatives in Washington, the basic problem still exists. We need to find methods of allocating limited resources in order to satisfy unlimited wants.

A short time ago economists(25)…goods into two categories, free and economic. The former, like air and water, were in(26)…abundance that economists had no concern for them. After all, economics is the(27)…of scarcity(匮乏)and what to do about it. Today many of these " free goods" are(28)…very expensive to use. Pollution has made clean air and water expensive for producers who have to filter their waste products, for consumers who ultimately(最终)(29)…the producers' extra costs, and(30)…taxpayers who pay for the government's involvement in cleaning the environment.

In the 1990s, almost all goods are (31)…Only by effort and money can they be obtained in the form. people wish.

Meeting the needs of people and froming resources available (32)… the basic activity of production. In trying to meet(33)…wants from limited economic goods, production leads to new problems in economics.

(19)

A.want

B.problems

C.wants

D.resources