题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The interest rate specified in the bond indenture is called the ()

A.discount rate

B.contract rate

C.market rate

D.effective rate

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.discount rate

B.contract rate

C.market rate

D.effective rate

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“The interest rate specified in…”相关的问题

更多“The interest rate specified in…”相关的问题

A.interest degree

B.interest speed

C.interest rate

D.interest value

A.Four

B.0.04

C.4

D.4/100

A.the price level and national income

B.the price level

C.national income

D.the interest rate

A、Periodic cash flow of interest and principal amortization payments on long-term assets that can be reinvested at market rates.

B、The effect that a change in the spread between rates on RSAs and RSLs has on net interest income as interest rates change.

C、Mismatch of asset and liabilities within a maturity bucket.

D、The relations between changes in interest rates and changes in net interest income.

E、Those deposits that act as an FI's long-term sources of funds.

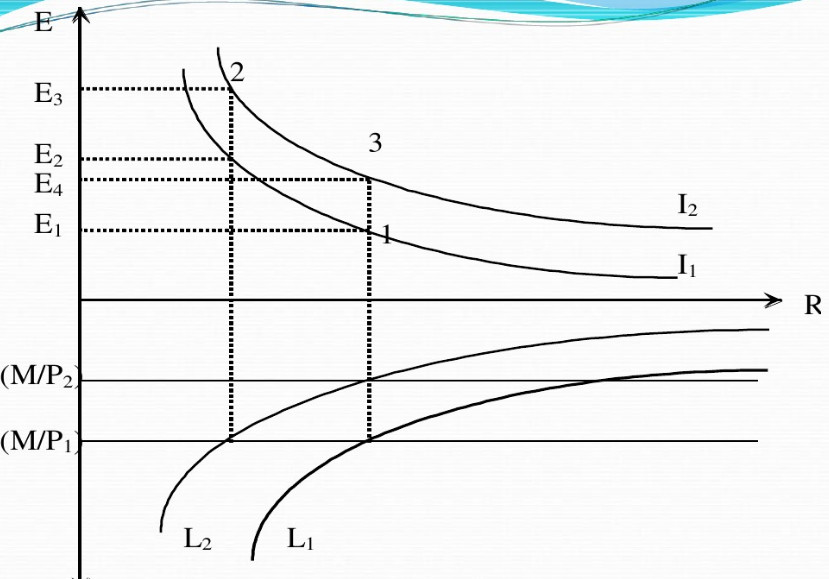

分析一下外国利率R*短期内上升的影响。在哪一种汇率制(固定汇率制还是在浮动汇率制)下,这种变化对产出的影响要小些?

Analyze a transitory.increase in the foreign interest rate,R*.Under which type of exchange rate is there a smaller effect on output--fixed or floating?

A、A decrease in interest rates generally leads to an increase in the value of assets.

B、Longer maturity assets have greater changes in price than shorter maturity assets for given changes in interest rates.

C、The absolute change in price per unit of maturity time for given changes in interest rates decreases over time, although the relative changes actually increase.

D、For a given percentage decrease in interest rates, assets will increase in price more than they will decrease in price for the same, but opposite increase in rates.

E、None of the above.

A、It is equal to the duration of the assets minus the duration of the liabilities.

B、Larger the gap in absolute terms, the more exposed the FI is to interest rate shocks.

C、It reflects the degree of maturity mismatch in an FI's balance sheet.

D、It indicates the dollar size of the potential net worth.

E、Its value is equal to duration divided by (1 + R).

假设实际货币总需求出现下降,即实际货币总需求函数(曲线)向左移动。试分析实际货币总需求下降对汇率、利率和价格水平的短期影响和长期影响。

Suppose there is a reduction in aggregate real money demand,that is,a negative shift in the aggregate real money demand function.Trace the short-run and long-run effects on the exchange! rate,interest rate,and price level.

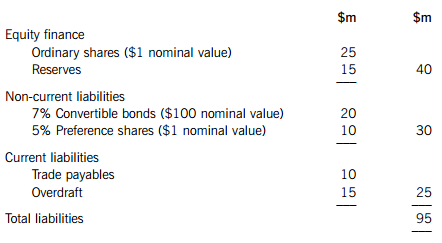

The statement of financial position of BKB Co provides the following information:

BKB Co has an equity beta of 1·2 and the ex-dividend market value of the company’s equity is $125 million. The ex-interest market value of the convertible bonds is $21 million and the ex-dividend market value of the preference shares is $6·25 million.

The convertible bonds of BKB Co have a conversion ratio of 19 ordinary shares per bond. The conversion date and redemption date are both on the same date in five years’ time. The current ordinary share price of BKB Co is expected to increase by 4% per year for the foreseeable future.

The overdraft has a variable interest rate which is currently 6% per year and BKB Co expects this to increase in the near future. The overdraft has not changed in size over the last financial year, although one year ago the overdraft interest rate was 4% per year. The company’s bank will not allow the overdraft to increase from its current level.

The equity risk premium is 5% per year and the risk-free rate of return is 4% per year. BKB Co pays profit tax at an annual rate of 30% per year.

Required:

(a) Calculate the market value after-tax weighted average cost of capital of BKB Co, explaining clearly any assumptions you make. (12 marks)

(b) Discuss why market value weighted average cost of capital is preferred to book value weighted average cost of capital when making investment decisions. (4 marks)

(c) Comment on the interest rate risk faced by BKB Co and discuss briefly how this risk can be managed. (5 marks)

(d) Discuss the attractions to a company of convertible debt compared to a bank loan of a similar maturity as a source of finance. (4 marks)